Hard Assets Can Buffer Market Volatility

In a time of uncertainty, hard asset investing can lower risk and provide steady return.

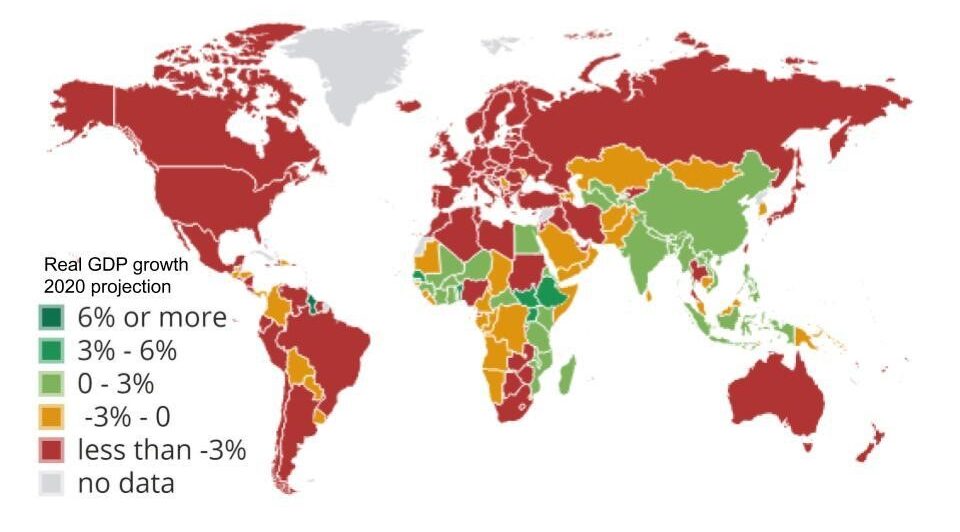

Across the world, economies are re-emerging from an unprecedented economic pause due to the COVID pandemic. Economic growth forecasts have been slashed, despite unprecedented levels of fiscal and monetary stimulus.

Source – Real GDP growth projections IMF – April 2020

Despite this bleak outlook for economic activity and increasing geopolitical risks, capital markets have been charging ahead seemingly unaffected. Stocks are near all-time highs, while bonds have continually set new records. Treasury yields are at, or near, all-time lows, with most experts advising investors to lower their expected returns over the next 5 to 10 years.

Apprehensive about risks such as a second wave of COVID-19 infections, a looming corporate debt crisis or the return of currency wars, highly regarded investors such as Warren Buffett, Carl Icahn, and Ray Dalio have now adopted defensive positions in anticipation of downside ahead.

One approach to manage this pervasive uncertainty is to invest in hard assets or in instruments directly secured by them. Tangible hard assets such as equipment and property tend to retain their value better than intangible credit or equity instruments during market downturns.

Often these investments can generate portfolio income, such as charging interest on an asset-backed loan, or earning revenue from renting or leasing the asset. The ability to sell the assets provides some downside protection in the event that the counterparty cannot meet its obligations.

Asset Values Provide Protection

Tangibility is irrefutable. Everyone can agree on the physical presence and condition of an object. The steel of a helicopter or a rail car, the location of a house, the quality of soil on a piece of agricultural land; these do not change when the economy fluctuates or liquidity is squeezed.

During the global financial crisis of 2008, for example, the US Department of Agriculture registered a national average price drop of 3.2% in farmland, as compared to the 45% decline in the S&P 500 during that year.

The degree to which asset values decline in a market downturn depends in large part on their ability to continue to generate cash flow, and how robust of a secondary market exists. It is important to understand these factors in your evaluation of potential risk, though it is often possible to estimate this by looking at how similar assets performed in past recessions.

Leasing and Lending Provide Even Greater Protection

In addition to the protection offered by the asset-backing itself, structuring an investment as a loan or a lease offers even greater protection. The cash flows generated from a lease or a loan can provide partial monetization and liquidity, while a loan has the added protection of not suffering a value impairment until the asset value has fallen below the Loan-To-Value (“LTV”) ratio of the loan itself.

For example, acquiring aircraft and leasing them for 5-7 years to solid credit counterparties can generate more than the value of the asset in terms of cash flow payments. Lending at a 75% LTV means that the value of the asset can decline by 25% before the value of the loan itself is impaired.

Unlocking Attractive Opportunities

Since the Financial Crisis of 2008, traditional banks have minimized lending to small and medium enterprises, creating an opportunity for private investors. Non-bank loans now account for over 40% of all U.S. loans, with Preqin estimating that this will total over $1 Trillion by the end of 2020. Despite this flood of capital, the yield on private debt has remained steady at its 10% average since 2008, which compares very favourably to the average BBB tradable bond yield of less 2.5%.

The key to unlocking attractive opportunities are to find assets that are exclusive enough so as to not be accessible to everyone, yet not so unique that there is not a robust secondary market in the event that they need to be sold. Ideally the market for these assets would be underpinned by strong, fundamental tailwinds that will support resale values for the life of the investment.

For example, heavy construction equipment leased or used as collateral to lend to operators that generate cash flow from multinational construction firms can provide a safe, income-producing investment that benefits from government infrastructure spending to bolster their economies. If the equipment is chosen properly, there is a deep enough market to either lease or sell the equipment to another user in the event that one counterparty does not make its payments.

Access Challenges

While the general virtue of hard assets is easy to recognize, adding the appropriate exposure can be more challenging for investors. Most asset-backed investments are illiquid and require specialization in terms of accessing, evaluating and structuring the investments. Those that are easier to access tend to trade at high premiums to value, which reduces both return and downside protection.

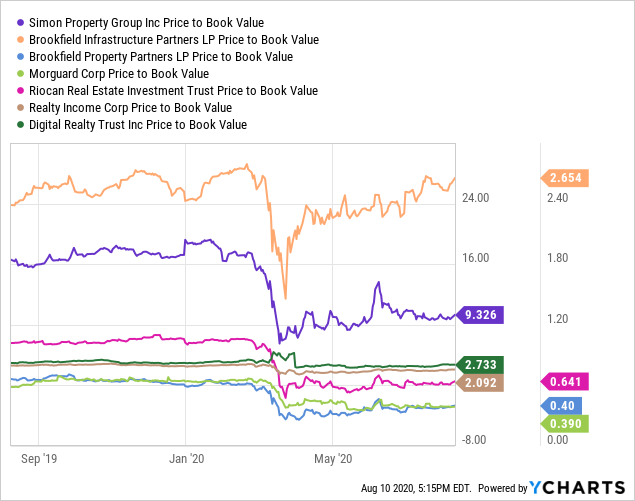

For example, residential real estate (although the US remains an exception) is trading near all-time low cap rates, while listed REITs trade at an average price-to-book of 1.94x the book value. This is lower than the market value of the underlying properties, but certainly there remains a large premium to market value.

Source: YCharts

In addition, having the expertise and resources to properly source income-producing opportunities, evaluate the underlying assets, and structure a security that ensures the ability to recover and resell the asset in event of non-payment requires a fairly high level of planned investment.

Heirloom’s Fixed Return Fund

To help ease these access challenges without having to pay the hefty premiums of listed vehicles, Heirloom Investment Management launched the Heirloom Fixed Return Fund. This fund combines a diversified portfolio of primarily asset-backed, income producing investments, with enhanced liquidity and a more aligned fee structure versus most private credit and asset leasing funds.

Heirloom’s award-winning thematic investment strategy means that it focuses on income-producing assets that are backed by strong, secular trends, providing support for underlying asset values.

The Fund’s strategies include:

- Own-to-Rent single family houses in second-tier US cities;

- Owning or lending against helicopters that are leased for ultimate use by quasi-governmental users such as air ambulance, police forces and utility operators;

- Lending to contract miners, secured by the value of the mining equipment and by an assignment of payments from large, multi-national mining companies;

- Lending to US law firms, secured by a diverse portfolio of client receivables;

- Lending to plaintiffs in commercial disputes, secured against the ultimate settlement or court-ordered judgement;

- Acquiring portfolios of music copyrights that earn royalty payments whenever the songs are played on the radio, streamed or played in movies/tv or live events;

Besides the asset-backed investments, the Fund has also taken additional steps to protect investors from downside risk and ensure investor-manager alignment. The Fund has adopted a “no management fee” structure to align interests and reduce risk for investors by giving investors first claim on any returns. In addition, Heirloom

maintains an equity layer that absorbs any monthly losses that may be experienced, which it cannot draw down upon unless it is at least 10% of the total fund value.

We believe that this is a substantial improvement on the typical fund fee model, which pays managers before investors, incents managers to asset gather, and does not require them to have any real “skin in the game”.

In addition, investors can choose between 6-month, 18-month and 36-month notice liquidity options for their investment, all of which provide greater liquidity than most locked-up, closed-ended private credit or asset-owning funds.

As we all face unprecedented times, investors are encouraged to de-risk their portfolios with investments that are uncorrelated to traditional asset classes and have additional built-in security built. The Heirloom Fixed Return Fund offers this in a more liquid and more aligned format than most other similar funds, which helps investors add these attractive, but hard-to-access strategies to their portfolios.

(If you would like to speak with someone at Heirloom to discuss the ideas presented here, or to learn more about the Heirloom Fixed Return Fund, please contact Beth at [email protected].)

Sources:

https://www.ft.com/content/ae093bea-62ba-11ea-b3f3-fe4680ea68b5

https://globalnews.ca/news/7081695/coronavirus-second-wave-canadian-economy/

https://www.cnn.com/2020/04/25/economy/corporate-debt/index.html

ABOUT HEIRLOOM:

Originally the in-house investment management function for a Canadian single family office, Heirloom offers flexible institutional-quality investment solutions designed specifically to help family offices and high net worth individuals achieve their goals. Its services include advisory over the entire portfolio as a full Outsourced Chief Investment Officer, to offering advice or managing investments in specific themes or asset classes, to offering co-investment opportunities in specific opportunities or themes.

Heirloom’s macro-thematic investment strategy invests across assets classes and geographies, focusing on allocating capital to long-term trends and market dislocations with a heavy focus on risk understanding and control.

Its approach has been used by leading pension plans and sovereign wealth funds for 20+ years. This strategy is supported by extensive academic research and has been advocated by McKinsey as how all investors should manage their money to generate the best risk-adjusted returns over the long-term.

DISCLAIMER:

This document is for information purposes only and is not intended as an offer or solicitation to invest. The material in this document is intended only as a reference and should not be relied upon as investment advice or for any other disclosure purposes. This is intended for accredited investors only. Past performance is not indicative of future results and there can be no guarantee that this strategy will achieve its investment objective.

This document is based upon sources of information believed to be reliable but no warranty or representation, expressed or implied, is given as to its accuracy or completeness. All opinions and estimates contained in this document constitute the Heirloom’s judgment as of the date of this report, are subject to change without notice and are provided in good faith but without legal responsibility. We assert that the reader is solely liable for their interpretation and use of any information contained within this document.

Any investment involves a degree of risk, including the risk of total loss. The risk information presented herein endeavours to capture some but not all risks associated with an investment strategy or product.