By: admin

Uncorrelated return, insured risk, quick payback: small litigation finance as a genuine alternative.

Seeking out niche investment areas that are hard to reach, or that some may find too onerous to develop – that’s part of Heirloom’s DNA. We seek to enable investors to access uncorrelated returns in times that can only be described as economically turbulent. In this case, it’s small litigation finance: an uncorrelated return with insured risk, that is expected to pay back much faster than many other legal finance investments – often in less than 12 months. As an added benefit, it offers positive impact by providing access to justice for those who would otherwise be unable to afford it.

An investment approach that moves away from the mainstream

With it becoming increasingly difficult to generate returns from a traditional portfolio, investors have been shifting towards alternative investments; diversifying away from traditional stocks, bonds and real estate, and strengthening their risk-adjusted returns.

In this economy, Heirloom focuses on alternatives that are uncorrelated, or untethered to the rest of the economy. These genuinely alternative investments aim to chart their own course, regardless of macroeconomic conditions, and are designed to offer stability and downside protection, while generating yield. As discussed in “Truly Alternative”, filtering alternatives to find those that offer genuine diversification is critical to ensuring a truly uncorrelated opportunity.

Focusing on esoteric or niche opportunities that require expertise to develop, yet are under-the-radar of the large investment houses is Heirloom’s specialty. By focusing on these genuine alternatives, we believe we can construct investments for investors that offer better risk-adjusted returns that add meaningful diversification, which helps lower portfolio volatility and risk without compromising on returns.

An overview of litigation finance

As the legal system evolves and laws become more complex, and with litigation and lawyers becoming more specialized, the judicial process continues to get more expensive. This is making it more difficult for many plaintiffs to afford representation and to pursue justice.

In its simplest form, litigation finance is when a third party invests in a lawsuit by funding the plaintiff or law firm representing the plaintiff in exchange for a share of the verdict or settlement. It’s an asset class that is more insulated from the global economy and can offer strong portfolio diversification. Lawsuits and settlements, after all, happen regardless of whether the economy is booming or in a recession.

Litigation finance has provided outsized historical returns with strong growth forecasts: it’s predicted that the investment potential for litigation funding in Europe is set to reach nearly USD 3.7bn in 2025 (+100%), compared with USD 17.8bn globally (Litigation Finance Journal, October 2022).

Litigation finance helps to enable access to justice by restoring balance to disputes. It allows the merits of the case to determine the outcome, rather than which side is better resourced. This encourages fairness and efficiency across the court process by reducing the chance of one-side spending their way into multiple levels of challenges and delays to dissuade the other side from continuing their claim.

Heirloom is financing a diversified portfolio of small litigation claims in the UK

Some litigation finance is focused on higher risk, higher return outcomes; but these outcomes can be uncertain and can also take many years to deploy investor capital and deliver a return.

One subset of litigation finance that we find more stable and with a shorter duration is funding small consumer protection style claims. We have developed this opportunity in the UK, which has a strong regulatory and judicial environment for such claims. To minimize our risk, we take out insurance on each loan, which covers our investment in the case that a claim is unsuccessful.

The majority of the claims that we fund are consumer protection cases: such as miscalculated credit card interest cases or undisclosed commissions earned by fiduciaries that were relied upon for advice. These claims generally fall under a set of points of law that have already been won, known as ‘established precedents’. So, if the cases are properly vetted and do not introduce unusual circumstances, the odds of success should be quite high, and the court process relatively short.

The key to developing this investment opportunity is finding a way to handle the large administrative burden that comes with funding 1,000+ small cases with fast turnover with 15-20 law firm partners. In general, we like situations where we earn a return less by taking risk of capital and more by being willing to take on grunt work – which has come to be known as “process alpha”. The systems and processes required to build a properly diversified portfolio across law firms, case types, case law, court circuit, defendants and solicitors takes significant effort to develop, but the overall opportunity set is not large enough to attract large institutional investors. This is our sweet spot, with the resulting opportunity a natural fit for high-net-worth-investors, family offices and their advisors in our opinion.

Key benefits of this niche opportunity

Below are some of the reasons we really like this opportunity:

| Attractive uncorrelated target returns – Returns that compete well against other uncorrelated return sources, delivering the return profile of mezzanine lending with the low risk of senior-secured loans. The source of the return is primarily earned through administrative effort rather than taking on substantial risk of capital loss, which helps to create a more reliable return stream. | |

| Low risk profile – 1,000s of small fundings(<£50,000) across a diversified pool of cases, most of which fall under an established legal precedent, and thus do not carry high legal risk. | |

| Investment with insurance – Each claim carries full Heirloom-funded insurance coverage (of both adverse costs and own costs), in the event the claim is denied. | |

| Short duration – 9-14 months expected duration of each claim is shorter than most litigation finance cases, providing faster realization of return and lower valuation uncertainty. | |

| Fast/full capital deployment – Capital is fully deployed immediately, earning return for the entirety of the investment period. This is in contrast to most litigation fundings which often do not draw the majority of the committed capital, and tend to put most of the drawn capital to work for relatively short periods of time, leading to a low return on committed capital. |

Expertise combined with insurance – for a win whatever the outcome

The Heirloom team already has over 10 years’ in-depth experience in litigation finance. We’ve used our expertise to implement processes and technologies that streamline the administrative burden, making it a rare opportunity for solid returns – and making it difficult for others to offer this niche strategy.

Heirloom has brought in regimented processes and uses several tools to ensure the appropriate cases are focused on, and to minimize case risk. Three independent expert opinions in the specific areas of case law are received on the merits of the case generally and whether sufficient precedent exists to make the case an investment opportunity. Heirloom’s internal litigation finance expertise also judges the merits of the case and the evidence. Additionally, we have introduced a highly standardized documentation and due diligence process, which further enhance our ability to evaluate the cases we are considering.

All fundings come with insurance from an A (or higher) rated insurer that covers the full costs of the funding in all events (including plaintiff fraud), to protect, at a minimum, our principal funding, and often provides coverage of our anticipated return as well. In addition, ·all solicitors work on a ‘no-win-no-fee’ basis, so we are aligned with the law firms’ success.

For consumer protection cases, expectation is a 75% success rate with average case turnover of 9-14 months.

How it works

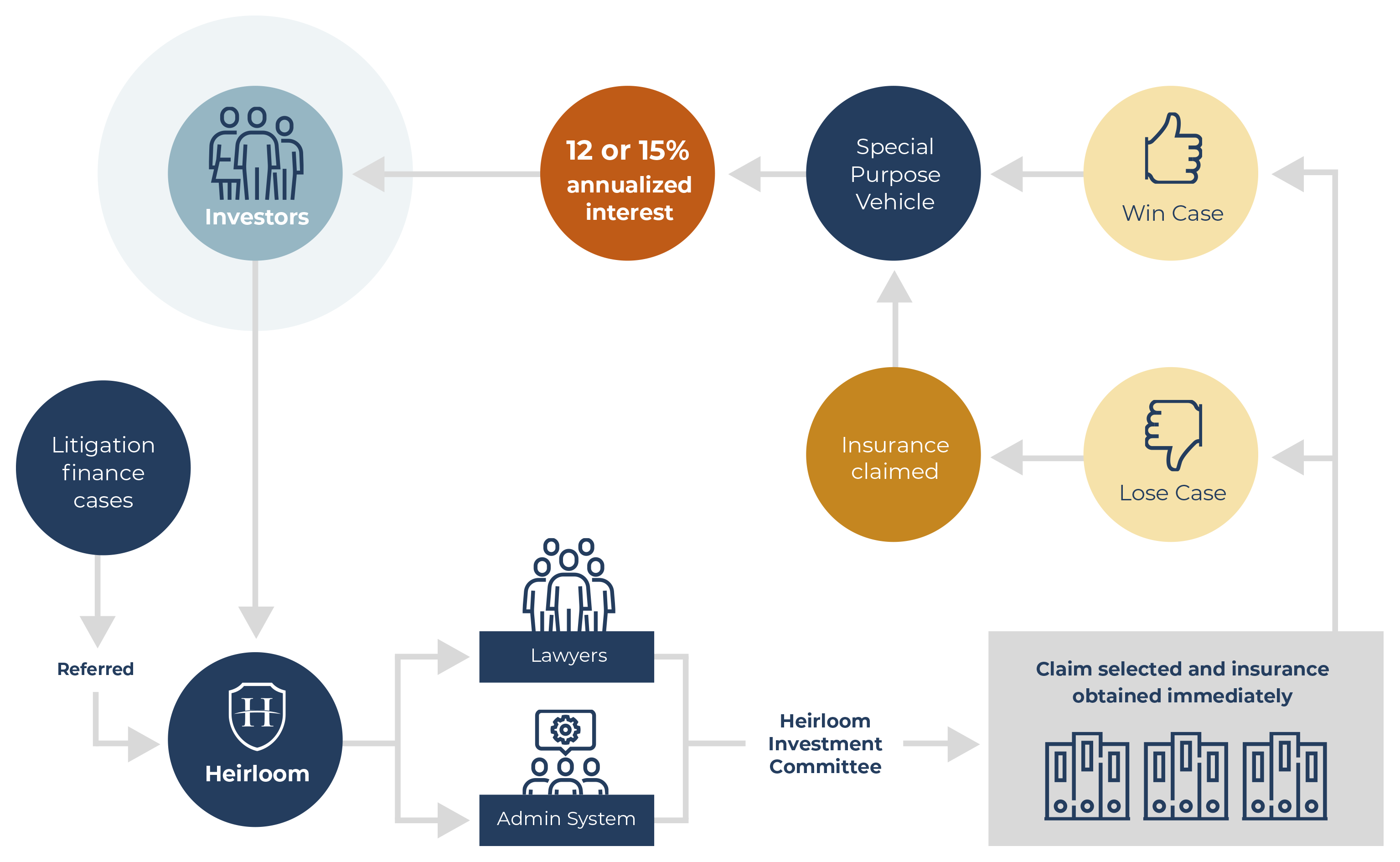

- Heirloom enters into a partnership with a law firm, agreeing to fund claims that meet its criteria provided the law firm agrees to use Heirloom’s standardized documentation.

- Law firm partner undertakes initial due diligence and refers those claimants that require funding.

- Claims are vetted by an independent expert selected by Heirloom.

- Heirloom’s Investment Committee reviews the claim and decides whether to fund.

- Insurance is taken out immediately based on an automatic approval if the claim meets pre-agreed criteria.

- If the case is won, the proceeds are paid to the lawyer’s trust account, where it is divided into the shares for Heirloom, the law firm and the claimant.

- If the claim is not won, the insurance is paid to the lawyer’s trust account, which the law firm uses to repay Heirloom the amount it invested.

- External investors participate by lending to Heirloom Litigation Funding 2022 SPV XI. Heirloom does not charge the SPV any fees and earns its economics via its equity ownership – it is not permitted to extract any value unless it would leave at least a 40% equity buffer.

A rare opportunity that puts your capital to work right away

There’s plenty about this UK litigation finance opportunity that warrants further investigation: from access to solid, uncorrelated returns, hedged risk and insurance coverage, to faster payback. Untethered to the rest of the economy, this is a carefully vetted, genuinely alternative investment opportunity that shouldn’t take years to deliver returns.

With access to this particular opportunity you can put your capital to work right now; with a shorter lock-up plus the opportunity for steady returns and higher capital protection than most litigation finance investments.

Want to learn more about investing in small litigation finance? Find out more from Heirloom.

Disclaimer:

This document is for information purposes only and is not intended as an offer or solicitation to invest. The material in this document is intended only as a reference and should not be relied upon as investment advice or for any other disclosure purposes.

Past performance is not indicative of future results and there can be no guarantee that this strategy will achieve its investment objective.

This document is based upon sources of information believed to be reliable but no warranty or representation, expressed or implied, is given as to its accuracy or completeness. All opinions and estimates contained in this document constitute the Heirloom’s judgment as of the date of this report, are subject to change without notice and are provided in good faith but without legal responsibility. We assert that the reader is solely liable for their interpretation and use of any information contained within this document.

Any investment involves a degree of risk, including the risk of total loss. The risk information presented herein endeavours to capture some but not all risks associated with an investment strategy or product.

Litigation finance, like all investments, is speculative in nature. It involves substantial risk of loss due to low liquidity and binary outcomes. We encourage our investors to evaluate the opportunity very carefully and to make independent investigations before making an investment into litigation funding of any type. Success of any particular claim depends on the claim’s facts and circumstances, as well as the law and interpretations thereof, which are subject to change. Though most claims are insured, the financial viability of the insurer cannot be guaranteed. Therefore, we cannot warrant or guarantee the success of any litigation financed through Heirloom.