By: admin

Exploring alternative investing means finding the genuine alternative

The search continues for investment vehicles that deliver consistent returns that are not a function of easy to access traditional securities. In these times of market volatility, genuine diversification of return streams within portfolios can help bring greater stability. In this article we look at how genuinely alternative investing can be a great addition to portfolios, and how to incorporate opportunities that are usually hard to access.

Finding differentiation and value in a volatile, unpredictable market

In our opinion, the key levers of economic growth, monetary policy via central banks, and fiscal policy via governments, are in an impossible situation. The core economy in developed nations is weak, driven by low productivity growth, demographic headwinds and the high cost of transition to a less environmentally-destructive energy base. Overstimulation has caused massive asset price inflation, which in turn has led to central banks and governments being put in a position of having to manage a controlled detoxification process.

Speculation on their ability to manage this process carefully has led to increasing volatility in asset prices. The global economy remains highly unpredictable, and investors continue to face increased uncertainty; a situation that is only growing.

The challenge for investors looking for steady and strong returns is a serious one, with it being increasingly difficult to generate this from a traditional portfolio. For more than a decade, easy returns were made by simply owning any asset. Now, investors must return to focusing on fundamentals and their ability to add value to things they are investing in.

We believe that in such an environment, the best opportunities are those that have a degree of asset-backing to provide downside protection, and that offer a reliable yield on which to base a steady return stream. However, it’s really important to understand the dynamics of this type of investing, to help ensure that you do benefit from reduced risk while looking to enhance any potential returns.

The shift to alternative investments

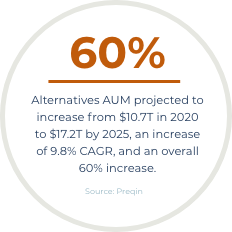

Investors have been shifting their portfolios towards alternative investments in an attempt to find alpha, diversify their portfolios away from traditional stocks and bonds, and strengthen their risk-adjusted returns. 2020’s report ‘Protect, Adapt, and Innovate’ from BCG Global Asset Management, stated that the key driver of this growth was: “investor demand for heightened performance, uncorrelated returns, illiquidity premiums, and other non-traditional return profiles, particularly as institutions across the globe face the challenge of a widening gap between assets and liabilities.”

Adding balance and diversity to a portfolio

Because Alternatives have different attributes and tend to behave differently than typical equity and bond investments, adding them to an investment portfolio can have a meaningful beneficial impact.

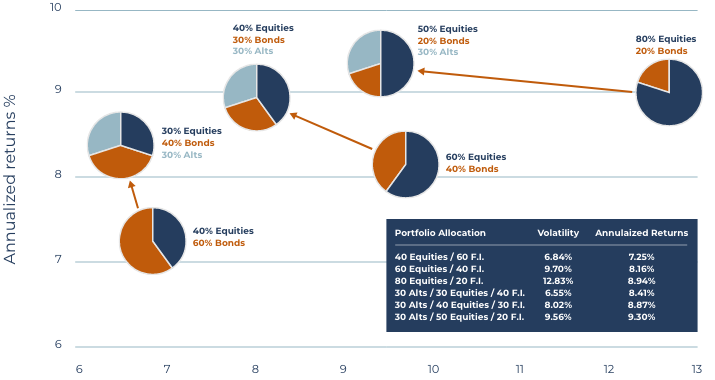

Research by JP Morgan shows that over the last 30+ years, adding Alternatives into an investment portfolio can improve returns while also reducing risk. For example, between 1989 and Q3 2022, shifting a portfolio from 60-40 Equity-Fixed Income to 40-30-30 Equity-Fixed Income-Alternatives resulted in a decrease of 1.76% annualized volatility, and an increased return of 0.55%. Alternatives can add balance and diversity to a portfolio to help smooth and grow returns.

When considering Alternatives, the focus should be on the outcome. Firstly, what is the challenge that needs to be looked at? Secondly, which is the asset that will provide the solution?

Alternatives and portfolio risk/return

Annualized volatility and returns, 1989-3Q22

Source: Bloomberg, Burgiss, HRFI, NCREIF, Standard & Poor’s, FactSet, J.P, Morgan Asset Management. Alts include hedge funds, real estate, and private equity, with each receiving an equal weight. Portfolios are rebalanced at the start of the year. Data is based on availability as of February 28, 2023

The challenges that come with traditional Alternatives

When looking to add investments in order to lessen portfolio volatility and risk, investors have to be careful to diversify using truly uncorrelated investments, rather than those that are actually correlated to the economy or general market, but may be slightly deleveraged or may have a lag effect.

Alternative investments is a broad category, including almost all assets that fall outside the mainstream investments of stocks, bonds or cash, and in some definitions – real estate. There is a range of alternative options, each with their own attributes and risk levels. So, understanding the differences is critical for finding the right portfolio supplement.

Traditionally, the most commonly recognized alternative assets are hedge funds, private equity and venture capital. With these assets no longer well kept secrets limited to an elite club of investors, capital has continued to flow into these types of strategies, pushing up valuations.

Alternatives such as hedge funds, private equity and venture capital may be alternative in the sense that they are non- traditional; but they generally exhibit a high degree of correlation to the general market (even if their proponents wish to argue otherwise).

- Hedge funds – Though hedge funds were originally designed to be ‘hedged’ and thus have no net exposure to the general equity market, most such funds carry a high net exposure weighting, and therefore should be viewed as only slightly de-levered equity market exposure. The primary draw of hedge funds is meant to be their ability to generate alpha, though particularly after their hefty fees and expenses, only a small proportion of hedge funds consistently earn alpha. In addition, much of their alpha was really alternative beta that could be generated more efficiently via cheaper liquid alternative products. With high fees and underwhelming performance, many investors have grown weary of hedge funds.

- Private equity – Private equity is a broad category that can refer to any equity investment made into private companies. The traditional usage of the term implies buyouts, recapitalizations and turnarounds. With the exception of turnarounds, most private equity returns these days is earned by adding leverage to a business and selling when market multiples are high. This has resulted in decent returns, but it has shown to be highly correlated and underperform a combination of leverage and a stock market index. One of the biggest attractions to this type of investment is that private equity funds tend to exhibit lower return volatility versus public markets, which is mistakenly associated as a lower risk. This is really a combination of a lag effect as private equity need only remark their investments periodically, and a smoothing effect where private equity firms will often use future projections to value their investments – rarely do such projections include recessions.

- Venture capital – Venture Capital includes providing growth equity to companies at various stages in their lifecycle. This is often at earlier stages in a company’s life. The ultimate exit point for a venture capital investment is usually the public market or a publicly listed company, and so there is a high degree of correlation between public equity markets and the ultimate value realization of such investments. However, these investments tend to be even longer duration than Private Equity, meaning they have an even higher degree of smoothing. On the flipside though, these investments tend to have low financial leverage, although they have exceptionally high operating leverage – few become big successes and most are failures. This high operational leverage makes them correlated to the general economy, and also to capital markets via their need for further funding. Thus, these can also be seen as a highly-levered economy and equity market exposure.

What do genuinely alternative investments bring to a portfolio?

Genuinely alternative investments can help lower portfolio volatility and risk without compromising on returns – and can thus indeed enhance risk-adjusted returns in a portfolio. Most of these investments genuinely exhibit low correlation to the economy and to any other asset class, and are often designed to perform in most market conditions.

Truly alternative assets should exhibit low correlation with the rest of the traditional portfolio. This is a necessity for them to function in the role of ‘risk reducer’. These are often esoteric or niche strategies, as the larger and more institutionalized they become, the more correlated they become with the rest of the market.

A few examples of genuinely uncorrelated alternative assets include:

|

|

|

Legal

|

Asset-backed

|

|

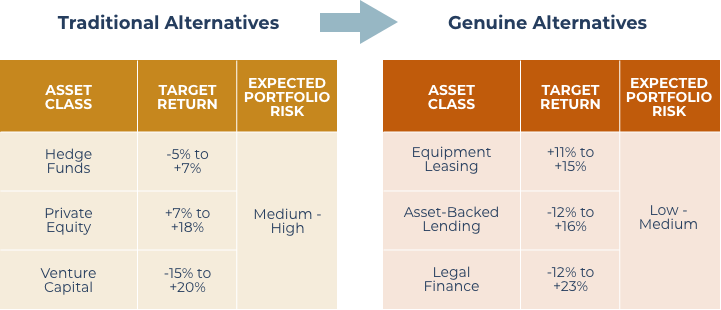

Moving from Traditional to Genuine Alternatives

Genuinely alternative asset classes may offer higher returns and lower risk than traditional asset classes (including traditional Alternatives), with little correlation to the general market.

Source: GMO, Heirloom Calculations Some of the details outlined in the associated charts are Heirloom projections based on GMO data and internal calculations. The results presented on this page are theoretical and do not represent actual results. Actual risk may be significantly different than expected risk. Actual results may significantly differ from the theoretical results being presented here due to market and economic conditions.

The challenge with genuine Alternatives is that they are more difficult to access, are generally not available in listed form, and often come with long lock-ups. The mega asset management houses do not tend to offer genuinely alternative assets, as the opportunities do not have sufficient capacity to support billion-dollar plus deployments. This is fine for family offices, individual investors and their advisors for whom allocations of under $25mm are meaningful to their portfolio; but they tend to be too small for large institutions to access.

Offering what’s missing from the mainstream

Though genuinely alternative assets were traditionally only available to sophisticated (very wealthy) investors or institutions, they are becoming more available to families and individual investors.

Originally the in-house investment management function for a Canadian single family office, Heirloom was created in 2015 to offer other family offices and ultra-high net worth investors access to the niche investments that it preferred for its own investment portfolio.

Heirloom specializes in Alternatives that are highly uncorrelated, or untethered to the rest of the economy – they aim to chart their own course regardless of macroeconomic conditions, and are designed to offer stability while maintaining and even improving yield.

A genuine alternative: the Heirloom Fund

The Heirloom Investment Fund SPC – Heirloom Fixed Return Fund SP (“Heirloom Fund”) is designed to provide a ready-made portfolio of attractive but hard-to-access niche Alternatives that can create diversification for most investor portfolios. The Fund’s focus on income and/or asset-backed opportunities offers downside protection and yield potential in today’s volatile markets. A few of its current themes include asset-backed lending, equipment leasing, agriculture, niche real estate, infrastructure and legal finance.

This Fund has a track record of meeting fixed return obligations to investors and surpassing its benchmarks. Its structure promotes alignment between Manager and investor through its fee structure and its Manager-funded Loss Absorption Shares that act as a first loss guarantee.¹

Heirloom offers investors those solutions missing from the mainstream wealth management and investment fund industry: truly alternative assets that are more resilient to market volatility that standard classes of investments and even traditional Alternatives.

¹For more details about the Heirloom Fund, marketing and performance documents are available upon request.

DISCLAIMER:

This document is for information purposes only and is not intended as an offer or solicitation to invest. The material in this document is intended only as a reference and should not be relied upon as investment advice or for any other disclosure purposes.

Past performance is not indicative of future results and there can be no guarantee that this strategy will achieve its investment objective.

This document is based upon sources of information believed to be reliable but no warranty or representation, expressed or implied, is given as to its accuracy or completeness. All opinions and estimates contained in this document constitute the Heirloom’s judgment as of the date of this report, are subject to change without notice and are provided in good faith but without legal responsibility. We assert that the reader is solely liable for their interpretation and use of any information contained within this document.

Any investment involves a degree of risk, including the risk of total loss. The risk information presented herein endeavours to capture some but not all risks associated with an investment strategy or product.